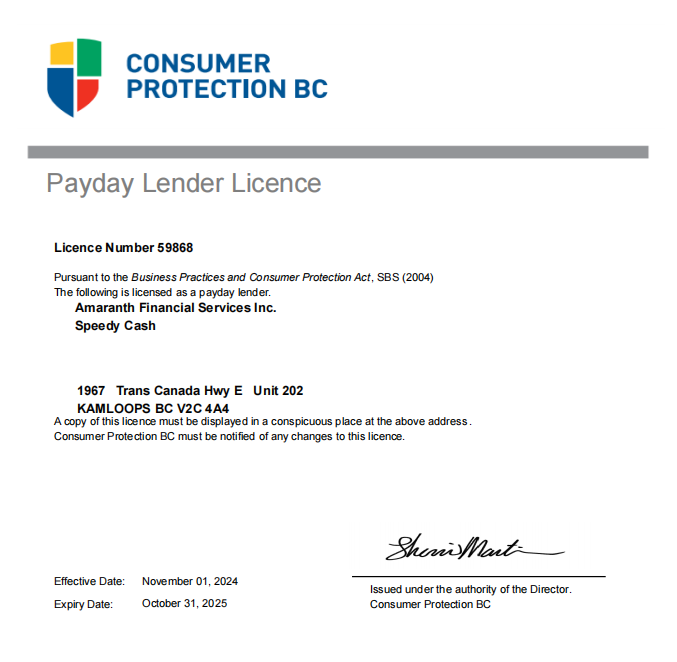

LIC. NO. 59868

- SERVICES

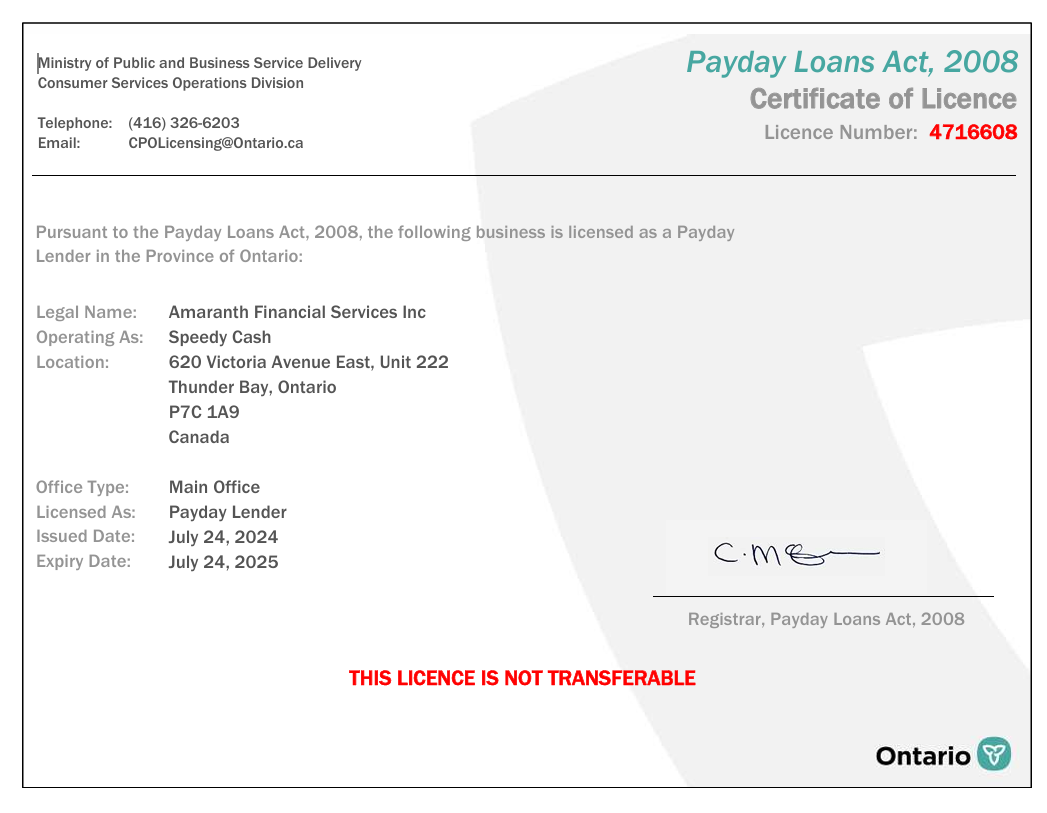

- PAYDAY LOANS

- CHEQUE CASHING

- BORROW NOW

- MAKE A PAYMENT

- LOCATIONS

- LOCATIONS

- PROMOTIONS

- FAQS

- CAREERS

- CONTACT US

- ABOUT US

- CAREERS

- PRIVACY POLICY

- LIC. NO. 59868

- BORROW NOW

- Payday Loans In Lethbridge

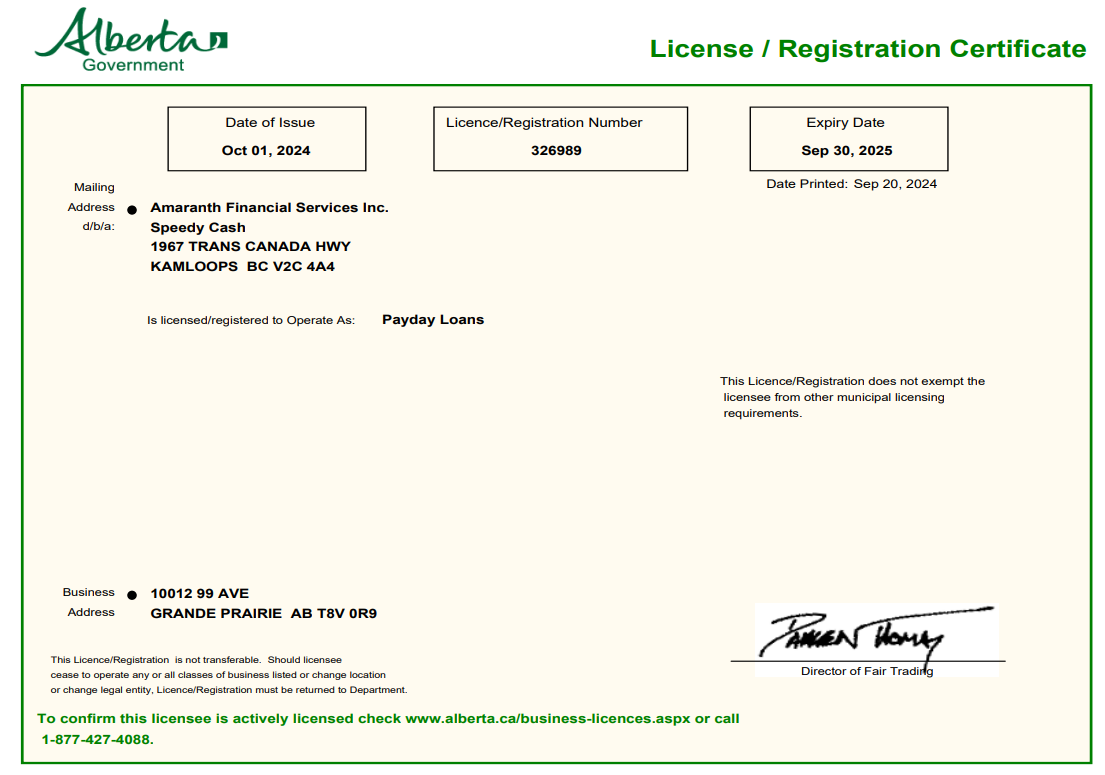

- Payday Loans In Grande Prairie

- Payday Loans In Terrace

- Payday Loans In Prince George

- Payday Loans In Penticton

- Payday Loans In Merritt

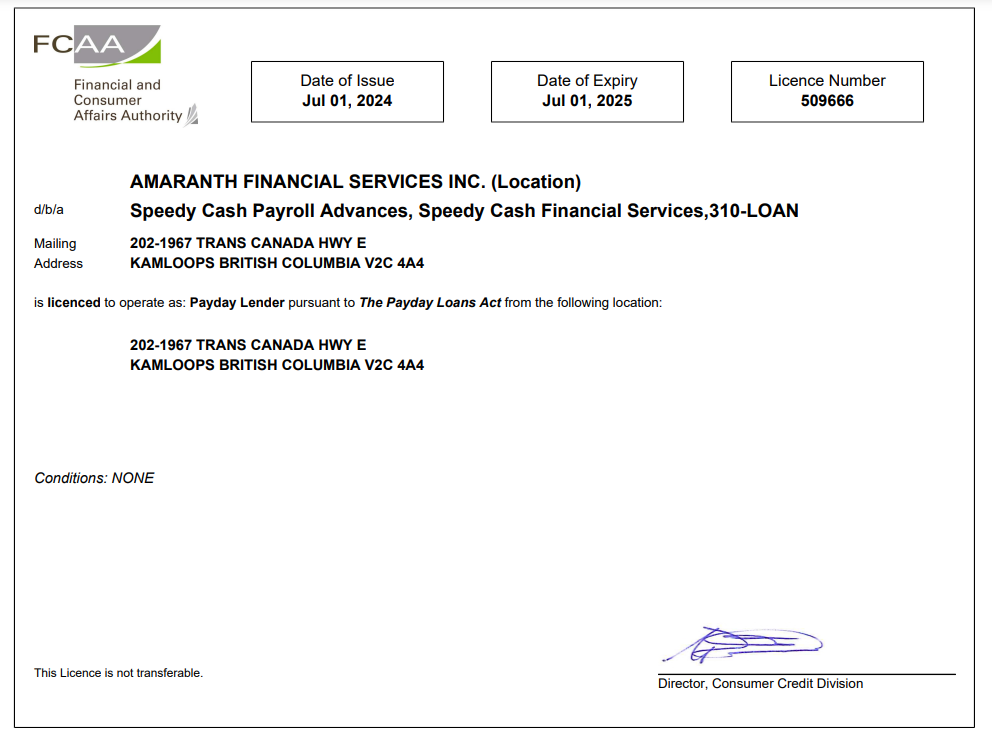

- Payday Loans In Kamloops

- Payday Loans In Duncan

- Payday Loans In Dawson Creek

- Payday Loans In Cranbrook

- Payday Loans In Chilliwack

- Payday Loans In Bridgewater

- Payday Loans In New Glasgow

- Payday Loans In Lower Sackville

- Payday Loans In Yorkton

- Payday Loans In Saskatoon

- Payday Loans In Regina

- Payday Loans In Prince Albert

- Payday Loans In North Battleford

- Payday Loans In Moose Jaw